The stage is set (or bedroom and bookshelf) for the Fed Chair’s keynote speech at the annual Jackson Hole pow-wow for central bankers, which is scheduled for 14.10 London time. This (virtual) conference is notoriously one of the potential policy-defining events of the year and 2020 may well be no different, even if the market is somewhat exhausted by the alphabet soup of measures announced during the Covid-19 crisis.

In fact that soup remains on the menu with AIT (Average Inflation Targeting), YCC (Yield Curve Control) and MMT (Modern Monetary Theory) all mooted as policy levers ready to be used by the Fed and to be announced in the review of its monetary policy framework in the upcoming FOMC September meeting. YCC a-la- Japan certainly seems to be off the table having not been mentioned in the latest meeting minutes, so traders are expecting a policy move to allow inflation to overshoot the 2% target and make up for the undershoots, in order to achieve two percent on average.

What does this mean for markets? As we have seen for some time, AIT would cement the prospects of low US real rates for the foreseeable future and keep the Dollar on the back foot. Going forward, the Fed would hope to see higher inflation and long-term yields which would at some point result in a slightly stronger dollar. Whether this will actually work is a question for another time, but the Fed’s credibility may rest on its ability to convince the market that it can achieve these goals.

DXY already priced?

With dovish-leaning comments expected from Powell and the Dollar taking another hit yesterday with cyclical G10 currencies rallying, anything else today will see a strong reversal in this trend and an equity market sell-off. The EUR did lag the other majors in Wednesday’s move, but we remind ourselves that long EUR speculative positioning is very stretched.

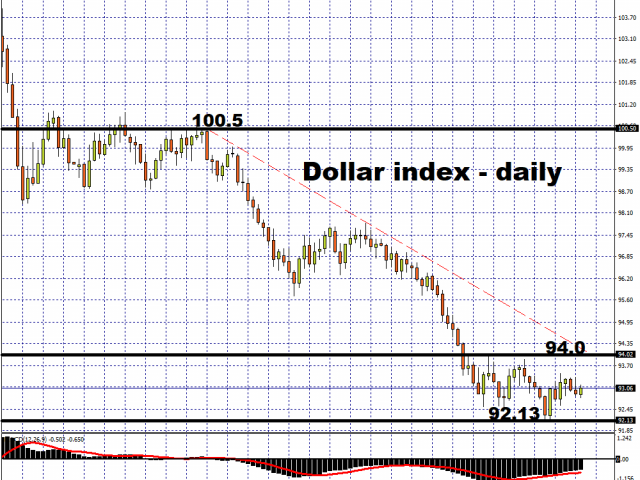

DXY prices are still oscillating around, but just under the long-term trendline from May 2011 so this appears to represent quite a barrier to any upside. Otherwise, the bearish trendline from the May highs this year may cap any dollar strength with strong resistance around 94.00. The August lows at 92.13 are the first target for sellers if we see the index continue its bearish momentum.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.